Ask a Debt Collector

by A Debt Collector

I did not plan to do this job; it’s not related to my degree and I thought it would feel scuzzy. Now I’ve settled in as a career collector, and have learned a ton from it.

First things first: DO you feel scuzzy about your job?

Most days: No, surprisingly. My debtors mostly owe for things like jewelry, store credit cards, or car accidents caused by their own carelessness. I have few qualms about holding people accountable for their own irresponsibility. However, if a funeral home ever contracted with my office, I would probably cry before/during/after every call.

Debt can legitimately happen to good people, and I do feel bad when I have to call on those good people — or worse, send the sheriff to their doorstep. But as long as people make the effort to make good on their debts, I can work with them, and not against them. That helps ward off the yucky feelings.

Are you like Dog the Bounty Hunter?

I’m not. My hair is not nearly as long, for one thing. And I stay at my desk all day, except to walk to the copier and the fridge. My firm works closely with a law firm, so we don’t go take people’s stuff if they don’t pay up; we just send the courts and the sheriffs after them.

What are some crazy stories you’ve heard? Like “dog ate my homework” but to the nth power?

I talked to a woman last week who claimed her payment got lost in the mail. That’s not too crazy, except that I keep notes on every call and that was the fourth consecutive month she had used that excuse! Another woman routinely claims that her relatives died, and last time I counted, she had five recently deceased grandmothers.

For the most part, people’s reasons for not paying are pretty pedestrian. Most people just forget, and I would rather hear a debtor say that honestly rather than feed me some lie.

Do you have any deep thoughts about debt, as a concept? Our ways of thinking about money seem so primal/dark/Gollum-y sometimes — I imagine you’ve thought about this, or encountered this, more than others. Can you shed any light?

My head spins at the depth of trouble people can get themselves into, and how quickly it can happen. Rarely is my firm the only agency going after a person, and I wonder about the toll that must take on a person to have so many lawsuits and judgments against him or her. People ask a lot about why they owe the amount they owe. The fees and interest spiral so far out of control that people can’t even remember what they owe, to whom, and why.

And I often wonder, when I’m collecting on a credit card, what does the debtor have to show for this? Did they at least get an awesome car, or was it a small purchase that just didn’t get paid down responsibly, and then it turned into a Whole Big Thing.

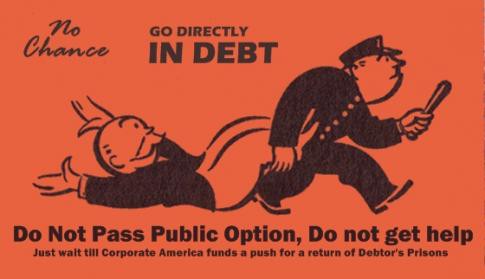

Debtors prison: for or against? (Don’t worry, I’m mostly kidding.)

Against! Sometimes!

Have you ever been in debt? Of any kind?

I’ve had a few small bills go to collections, and that taught me a lot about what not to do. The collectors weren’t horrible, exactly, but they weren’t empathetic either. Their approach never resonated with me as a debtor, and I vowed to be nicer to people when I was on the other end of the phone line.

Now I just have pretty boring debts, like student loans and a line of credit at a furniture store. But doing my job has helped me manage my bills a lot better, which is a nice perk.

Generally speaking, how much leeway do you have in terms of accepting offers for cents on the dollar?

A lot more than I ever expected. Routinely, people will propose a settlement offer that I’m certain my client will reject — like, 50% in some cases — and they’ll end up accepting it. Sometimes it’s just a matter of getting a file off the books rather than wasting too much more time tracking debtors down and wringing little bits of money out of them.

What makes you more likely to sympathize with someone?

Honesty! I can’t stand excuses or bullshit, but if a person just explains their life to me I am happy to listen. And if a person has been making regular payments for a while but then falls off, I do everything I can to keep them from getting into further trouble.

What is the final step in a debt collection? Like, if the person just keeps on not paying, how far do you take it? Do they give over first born sons?

There is such a thing as “uncollectable.” I don’t know if the threshold for determining that status is universal, but in our office, the uncollectables are usually very old, living off of social security, in poor health, and probably have other debts. So I guess … we keep trying, until you’re drowning in debt and on the way up to see Saint Peter. God, that makes us sound awful.

Frankly, a lot of people get away with just not paying. If they keep moving around, changing their phone numbers, hopping from job to job, and ignoring the doorbell when the sheriff shows up to serve them, there are times when we say “enough is enough” and quit wasting our time trying.

Do you ever get in a situation where you feel like you’re harassing a genuinely honest person who either has paid their debt and you don’t have updated records or who truly had NO IDEA about the debt?

Yes! Sometimes, clients accidentally place a file with two agencies, or fail to update their own records after reaching out to us. I can hear it in pepole’s voices when they have done the right thing but are still getting calls. It’s pretty easy to deal with, though: Just call the client and have them double-check their records. The important thing for the debtors to do in that situation is to pick up the phone and call if they think there’s been an error.

Any generalizations you can make about the types of people you most often encounter?

Oh, yes. I have spoken about the honest people who are trying to make things right, but those are the exception, not the rule. And those people quietly make payments every month, so I don’t get to talk to them.

My average debtor:

1) has a history with the courts, mostly civil suits but some criminal offenses along the lines of driving without insurance

2) never stays in one house/apartment/town for long

3) can’t hold down a job

4) still buys fancy phones and huge flatscreens

5) posts about those items on Facebook and fails to tighten their privacy settings

6) blames a lot of other people for their own debts

7) needs a lot of needling every month to get even a tiny payment

8) is often afraid to just pick up the damn phone with a question, ends up in more trouble

The work still sounds kind of scuzzy. Is there anything fun?

Yes! Part of my job is “skip tracing” people. That is an industry term for “stalking like a crazed ex-lover.” I’m on Facebook often, digging through people’s pages and guffawing at all the wit and wisdom (and the information people divulge, like their cell phone numbers, workplaces, and even home addresses. Those Bing maps that are part of Timeline? Yeah, those are useful.).

I do get warm-and-fuzzies when debtors tell me I’m the nicest collector they’ve ever heard from. I consider debtors to be pretty authoritative sources on behavior of collectors. I like helping people, or surprising people with the extent of my willingness to work with them to make a situation right.

A Debt Collector plans to keep collecting debt in one of the flyover states until there’s a job opening anywhere for “professional HGTV watcher.”